Don’t settle for second-rate delivery protection

You know what they say about assumptions...

Parcel Protect gives you over and above what parcel services and couriers offer. More than just insurance, it’s a solution that keeps your customers happy, saves you time, money and a whole lot of hassle.

Stop and ask yourself “Do my couriers and parcel services offer me this?”

- Cover for lost, damaged, and stolen deliveries

- Automatic replacement from your store or refund (up to $10,000 per item)

- Issues resolved fast - hours, not weeks

- Claims management and customer service handled on your behalf

- Admin time and hassle taken off your plate

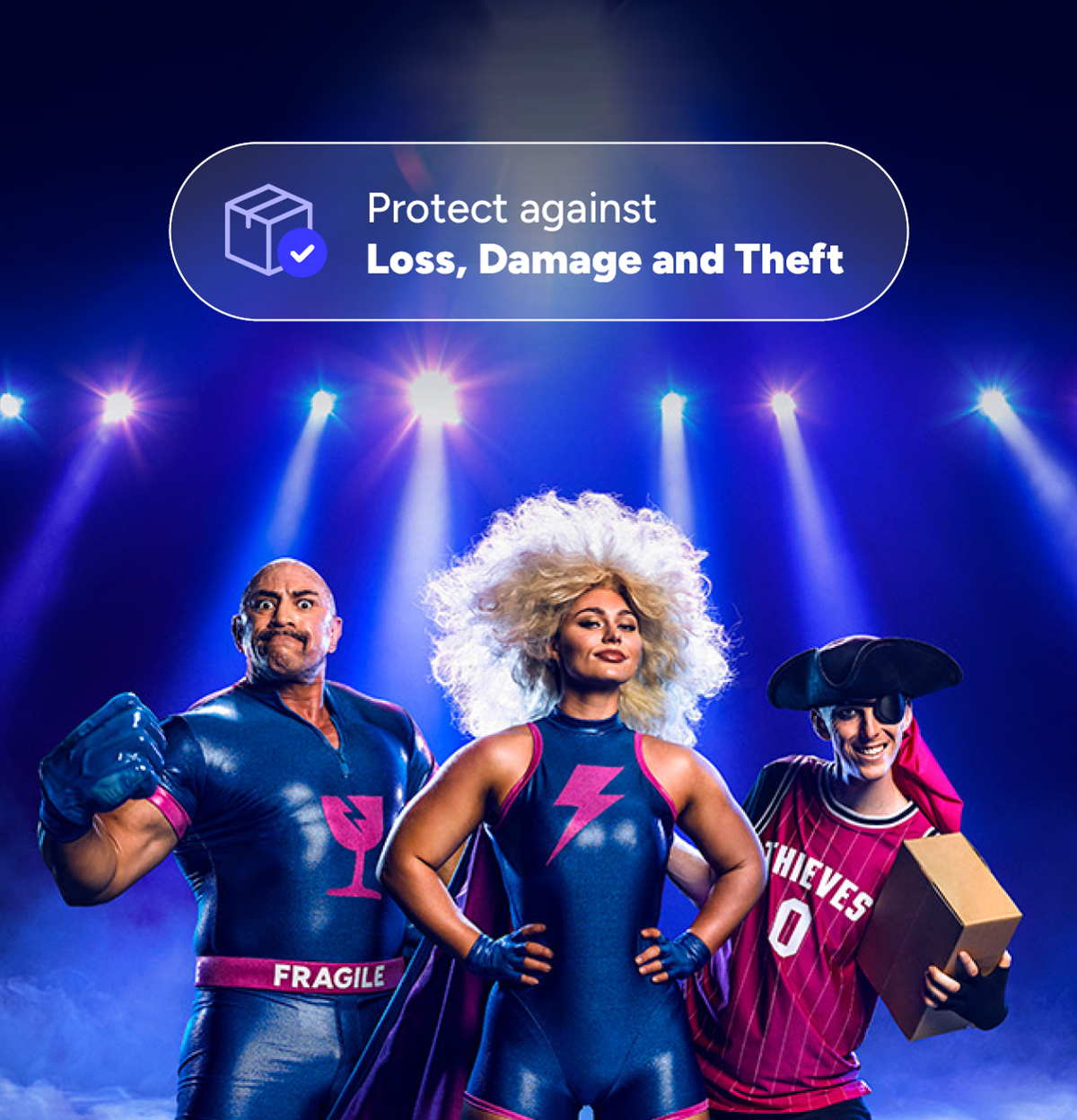

Comprehensive Delivery Insurance

Delivery protection to shield your orders from the delivery villains.

- Cover for accidental loss, damage, or theft

- Up to $10,000 protection per item

- Claims handled by professional insurance specialists

- 24/7 case lodgement & order resupply

- No excess payable

- Australia-wide coverage

- Full-value protection including freight and taxes

We’re backed by NTI, Australia’s transport and logistics insurance specialists with more than 50 years of experience in the industry.

From claim to resupply, fast

-

A quick fix for customers and another sale for you

When a claim is approved, we arrange a replacement order directly through your store. The new order follows your normal fulfilment process, ensuring a seamless experience for your customers.

This approach saves your team the time normally spent chasing up claims with couriers or issuing refunds. You make a new sale on the replacement order, maintain your reputation with customers and resolve delivery issues fast.

If a replacement isn’t the preferred option, we arrange a refund on your behalf, ensuring every claim is resolved quickly and professionally.

Why parcel service and courier coverage falls short

Coverage from parcel services and couriers might sound reassuring, but when you need it, it doesn’t always deliver.

- You handle the customer enquiry and all the admin

- Payout limits that often don’t cover the order value

- Exclusions for common issues like drops, damage, or weather

- No cover for parcels lost or stolen after delivery

- Claims that can take weeks to process

It’s not complete protection, and it doesn’t always help your business. We give you comprehensive coverage and service designed to protect your deliveries the way you need it.

Protecting your reputation

Every delivery is a customer moment. When it goes wrong, your response speaks volumes. We help you resolve delivery issues quickly and professionally, keeping customers confident and satisfied.

-

An experience that builds trust

We handle claims quickly and transparently, so customers feel supported from start to finish.

-

A competitive advantage

73% of customers are more likely to buy from a store that offers delivery protection*. It shows you take their experience seriously. *NTI ecommerce customer survey, 2023.

-

More time for what matters

Delivery issues cost businesses countless hours in staff time following up couriers and dealing with unhappy customers . We handle that part so you can get back to working on your business.

Delivery Insurance FAQs

-

How much does this delivery insurance actually cost

Our Basic Plan is 1% of each purchase with no minimum premium, so you can cover anything - small or large. For Enterprise pricing, speak to our team today. Parcel Protect is a pay-for-use model, so you only pay for what you ship.

-

What proof do customers need for claims?

Customers simply need their order number and the phone/email address used to place their order to commence a claim. From there, they’ll need to provide information about the issue and upload some photos via the portal if necessary. For lost or stolen parcels, a police report may be required.

-

How is this different from courier insurance?

Parcel Protect safeguards your relationship with your customer. It's a fully regulated Australian insurance program that works for you, not the courier or parcel service. We offer real insurance with higher limits and faster resolution delivering your promise to your customer

-

What if the customer is lying about damage?

Professional insurance verification processes protect against fraud while ensuring legitimate claims are processed quickly. All claims require proof depending on if they are lost, stolen, or damaged which we verify on your behalf – we take on the risk while you get an additional sale once claims are processed.

-

How quickly do customers get replacements?

Once claims are approved we place a new order through your store, customers then receive immediate notification that the issue has been resolved and resupply is on the way. You can then dispatch the replacement item.

73% of online shoppers

prefer stores that include delivery protection^

^source: NTI ecommerce customer survey, 2023.